Yeah, people kept using them to fill the bank with bees.

- 0 Posts

- 15 Comments

Or you had to write down a long ass code and re-eneter it when you were ready to continue!

3·1 year ago

3·1 year agoAnd the early explosion of bundle sites. Fanatical was BundleStars, Indie Gala, and ton others that had weekly, then bi-weekly and then seemingly daily bundles.

Oh and itch.io and GoG

2·1 year ago

2·1 year agoWhat they should be saying is that it’s like exercise.

Just because you know how to run or you know how to do a pull-up, you won’t necessarily be able to do so to the extent needed in a pinch. You have to stay in shape. You have a car, but the car could break down and you might have to walk a mile to the nearest gas station.

Likewise, with math, we run into situations all the time where being able to do simple math in your head you can prevent you from getting screwed.

Like at a car dealership, some will show you different payments and ask you if you want to get the premium insurance or skip the premium insurance and go with the lower payment.

Most will choose the lower payment. If you did the quick math* in you head though, you’d quickly see that the “lowest payment” is off and has a minimal car warranty bundled in.

Grocery shopping. I’ve seen where the price per ounce on the shelf doesn’t match the actual price per ounce.

Should you take the more distant job? It pays $5 more an hour, but is it worth driving 15 extra miles?

Should you take the delivery job that pays $20 an hour but will put an extra 50-100 miles a day on your car? It’s not just gas. Cars are a finite resource. Can you figure out the depreciation per mile?

When you buy a house: Should you buy a house now if it’s cheaper but interest rates are high or buy later when interest rates go down but the price may go up? How much money does each 0.25% in APR really mean to me? (Example: For a $400,000 house, a 0.25% APR difference is $83 a month or $1000 just that first year (not including compounding). With compounding, it can mean an extra $62 a month for the life of the loan for all 360 payments or $22,000! An extra 1% is quadruple that!)

If you think you would keep a house for only 5 years, which loan makes more sense? Pay a bit more in closing for a lower APR or pay nothing extra but get a higher APR? How many years in does the first loan come out ahead?

* Quick loan payment estimation (without compounding for short loans (<6 years):

Takes a while to read, but with practice, it’s quick to do in your head:

Take loan amount, number of years, and APR:

Ex. 10K at 6% for 5 years.

Think of it as a geometry problem. You have a triangle with one side at 10k (starting loan amount) on the y axis and 0 days (x axis) and the tip will be at 60 months (5 years) and $0.

At the halfway point (30 months 2.5 years) the principal balance (not counting interest) should be about $5000. So on average we can calculate $5000 * 6% APR for 5 years (or 30% total without compounding)

Original loan amount + non-compounded interest =

$10000 + ( $5000 * 30% ) = $11500

$11,500 divided by 60 payments = $191.66 /mo

0% interest would be $10,000/60 or $166.66

This already gets us really close to the real answer.

I threw the loan values into an online calculator and it came up with $193.33 for the monthly payment.$193.33 - $191.66 = $1.67 difference or 99.1% of the real answer.

This % difference due to compounding will vary based on the APR and and loan term but not the loan amount. So if you know which terms and APR you qualify for, you can figure this out ahead of time. For our 6% APR for 5 years example we know to add 1%.

If the sales person presents us with a significantly different monthly payment, then we know they snuck something in. I’ve personally run into this where all the payment options had a different service plan and/or extended warranty snuck in.

Also it’s good to know that the interest will cost us $26 a month vs 0% APR or paying in cash. Which helps us figure out if it makes sense to buy now (do we get $26 of benefit a month for having it now) vs waiting.

deleted by creator

It’s obviously a dry spaghetti measuring device. /s

Eh, that at least goes back to the days of dial-up (at least).

56k modem connections were 7k bytes or less.

The drive thing confused and angered many cause most OSs of the time (and even now) report binary kilobytes (kiB) as kB which technically was incorrect as k is an SI prefix for 1000 (10^3) not the binary unit of 1024 (2^10).

Really they should have advertised both on the boxes.

I think Mac OS switched to reporting data in kilobibytes (kiB) vs kB since Mac OS 10.6.

I remember folks at the time thinking the new update was so efficient it had grown their drive space by 10%!

In addition to the explanation others have mentioned, here it is in graph form. See the where the graph of 2^x intersects the y axis (when x=0):

https://people.richland.edu/james/lecture/m116/logs/exponential.html

This also has some additional verbal explanations:

http://scienceline.ucsb.edu/getkey.php?key=2626

The simplest way I think of it is by the properties of exponentials:

2^3 / 2^2 = (2 * 2 * 2) / (2 * 2) = 2 = 2^(3-2)

Dividing two exponentials with the same base (in this case 2) is the same as that same base (2) to the power of the difference between the exponent in the numerator minus the exponent in the denominator (3 and 2 in this case).

Now lets make both exponents the same:

2^3 / 2^3 = 8/8 = 1

2^3 / 2^3 = 2^(3-3) = 2^0 = 1

Package was being delivered by GOB Bluth.

“Return from whence you came!”

3·1 year ago

3·1 year agoWhy I prefer this prediction:

81·1 year ago

81·1 year agoFood scientists want to know OPs location.

3·2 years ago

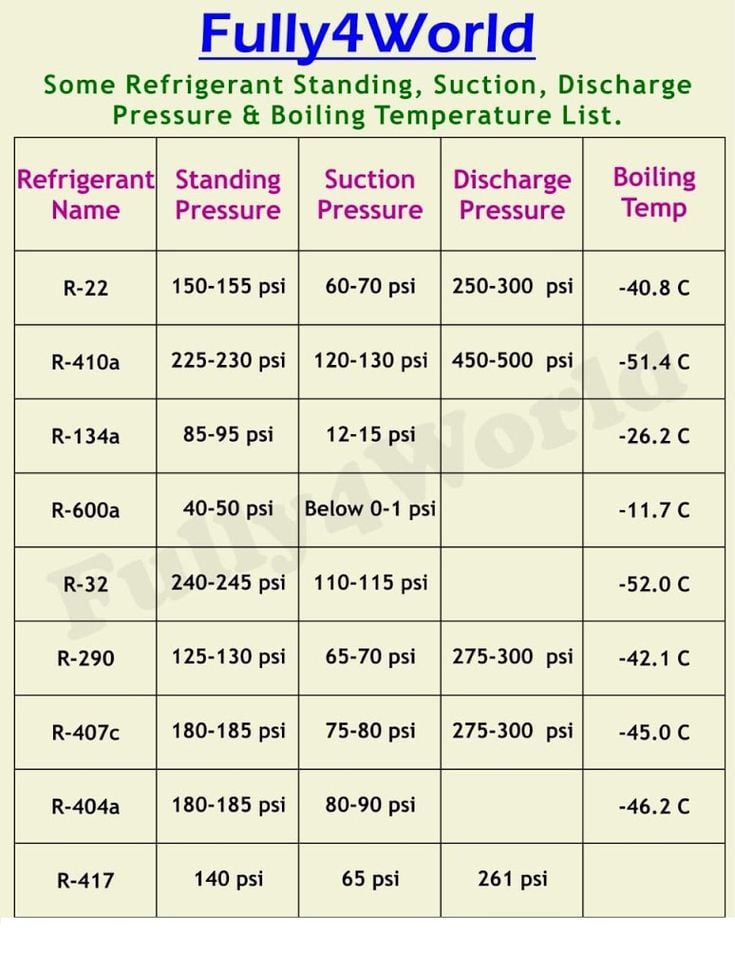

3·2 years agoThe difficulty (just looking at the refrigerant) is the huge differences in pressure needed between refrigerants.

Then you have to look at the compatibility of the compressor motor oils and the refrigerant.

One example

60 PSI to 85 PSI for R-22 and 105 PSI to 143 PSI for R-410A

Others:

4·2 years ago

4·2 years agoIn Air Conditioning a “ton” = 12000BTU of heat removal per hour.

It originates from the amount of heat removal over a period of 24 hours needed to freeze a ton of water at 0C:

https://en.m.wikipedia.org/wiki/Ton_of_refrigeration

A quick idea of what cooling/heating you need is your square footage (assuming 8ft ceilings) x 20.

So 600 sq ft of area would need a 1 ton AC or 12,000BTU. Again complicated by outdoor temperature, insulation of the home, and other factors.

Anyway, what the op was saying, for the same tonnage (cooling capacity) old ACs used a ton of electricity. Newer split units are crazy efficient.

Like in 2000 the new requirement for a home AC was a SEER (cooling vs electric usage) of 10. The higher the rating, the less electricity used for a given cooling capacity.

Nowadays you can get the cheaper split units which have ratings of 19-23 SEER2. So they use half or less than half the electricity for the same cooling. Also they can work as heaters in a pinch.

Edit: Quick googling shows that ACs from the 80s could be as inefficient as 6-7 SEER. So a modern 21 SEER2 unit would use 1/3rd the electricity!

Should also start calling tweets: X’cretions.

Twitter Feed: X’crement feed

Their public relations is pretty much a poop emoji already.

deleted by creator

DirectTV DSS was huge when it came out.

Now you only needed an 18" dish, no need to move it once it was aimed. Digital quality and 480p if I remember right.